center for responsible lending overdraft fees

The Center for Responsible Lending estimates that Americans now pay 175 billion per year in fees for abusive overdraft loans more than the 158 billion total paid out in loans. Overdraft fees are triggered by debit card point-of-sale POS transactions ATM withdrawals electronic bill payments and paper checks.

Report Finds Bank Overdraft Fees Climbed In 2019 For Fourth Straight Year Morning Consult

District of Columbia Office 910 17th Street NW Suite 800 Washington DC 20006 202 349-1850.

. Transactions that lead to overdrafts are often quite small. The Center for Responsible Lending CRL issued a report on June 3 calling on Congress to adopt legislation prohibiting banks from issuing overdraft fees for the duration of the COVID-19 pandemic. Now in the midst of a global pandemic and unprecedented economic turmoil CRL is calling on Congress to adopt.

In the case of debit card. Overdraft fees kick people when they are down. These fees disproportionately harm Black and Latino.

Their costs are borne by financially vulnerable consumers. WASHINGTON DC Bank of America Americas second-largest retail bank with about 235 trillion in assets today announced it will reduce overdraft fees and non-sufficient funds NSF fees aka bounced check fees for its consumer banking customers. During the economic crisis caused by COVID-19 the devastating impact of.

These overdraft fees make banks the very institutions we trust to safeguard our funds a hostile place for many of our nations most vulnerable financial households to put their money said Ashley. Send any friend a story As a subscriber you have 10 gift articles. More than 80 percent of the fees were paid by just 9 percent of account holders according to the Center for Responsible Lending.

Center for Responsible Lending 302 West Main Street Durham NC 27701 919 313-8500. It is the biggest bank thus far to do this. According to the Center for Responsible Lending a study of overdraft fees charged in 2019 found that more than 11 billion in fees were charged with 84 of those fees going to consumers with the.

The bank typically charges a fee averaging 35 for each individual overdraft transaction it pays. As you can see Regions Bank relies on overdraft-related fee income the most at 557 of total income. The Center for Responsible Lending enthusiastically supports this bill as a crucial measure for protecting consumers from abusive bank overdraft fees.

The top 20 fee-charging banks were responsible for 92 billion or 79 percent of the overdraftNSF revenue. CRL Praises Bank of America for Reducing Overdraft Fee. Tuesday January 11 2022.

Overdraft fees have a punishing impact on. Wells Fargo drew fire after an August report by The New York Times revealed a policy that allowed the banks accounts to remain open even after customers thought they had closed them prompting some customers to be charged thousands of dollars in overdraft fees. 8 percent of customers incur nearly 75 percent of all such fees.

According to the Center for Responsible Lending a study of overdraft-related fees charged in 2019 found that more than 11 billion in fees were charged with 84 percent of those fees assessed to consumers with the lowest average account balances. Overdraft protection a feature of. Which total 175 billion per year according to the Center for Responsible Lending.

Public Interest Research Group and the Center for Responsible Lending. District of Columbia Office 910 17th Street NW Suite 800 Washington DC 20006 202 349-1850. Center for Responsible Lending CRL Policy and Litigation Counsel Nadine Chabrier issued the following statement.

Financial institutions rake in billions annually through overdraft fees often at the expense of their most. Altogether customers of larger banks paid more than 11 billion for bounced checks and other overdrafts in 2017 according to the most recent data from the Center for Responsible Lending. Overdraft and NSF fees account for about 75 percent of customers total checking account fees and average over 250 per year.

Protection Act of 2009. Center for Responsible Lending. In 2019 it was seventh in the absolute amount among 20 sampled banks for a Center for Responsible Lending study.

Most overdraft fees are paid by a small fraction of bank customers. Whats worse these fees can quickly accumulate resulting in hundreds of dollars in fees per year. However it placed fifth when measured by overdraft and NSF fees as a proportion of net interest income at 177.

Center for Responsible Lending 302 West Main Street Durham NC 27701 919 313-8500. Never Pay Another Overdraft Fee. The Center for Responsible Lending applauds Bank of America for taking another important step that prevents costly overdraft fees for consumers.

When the customers next deposit is made the financial institution debits the amount of the overdrafts plus a fee averaging 34 for each incident. I am the director of the DC office of the Center for Responsible Lending CRL a not-for-profit. CFPB should take a closer look at overdraft fees crypto.

A new report released today by the Center for Responsible Lending CRL finds that in 2019 banks collected more than 1168 billion in overdraft-related fees through abusive practices that drain massive sums from consumers checking accounts. In some instances consumers can be charged as much as 35 for a purchase of 5 or less. Maloneys legislation is backed by Consumer Reports the National Consumer Law Center the US.

Bank overdraft practices cause many families severe financial distress in the best of times. Bank overdraft fees cause particular harm to low-income consumers and communities of color who are already disproportionately excluded from the banking mainstream. Mulvaneys decision to halt the CFPB from moving forward on addressing abusive overdraft fee practices will severely impact poor families and communities of color said Rebecca Borné Senior Policy Counsel at the Center for Responsible Lending.

Elizabeth Warren is widely perceived as the architect of the Consumer Financial Protection Bureau and she used the occasion of the agencys 10th anniversary to call for more robust oversight of cryptocurrency and banks overdraft practices. JP Morgan Chase JPM 18 Wells Fargo WFC 21 and Bank of America BAC -08 received. California Office 1970 Broadway Suite 350 Oakland CA 94612 510 379-5500.

The Center for Responsible Lendings data comes less than two months after reports that.

Banks Make Billions Off Of Unfair Overdraft Practices New Orleans Multicultural News Source The Louisiana Weekly

Banking Services Savings And Payment Services Ppt Download

Bank Overdraft Fees C Span Org

Center For Responsible Lending Home Facebook

Banks Earning Less From Overdrafts But Critics Still Find Fault American Banker

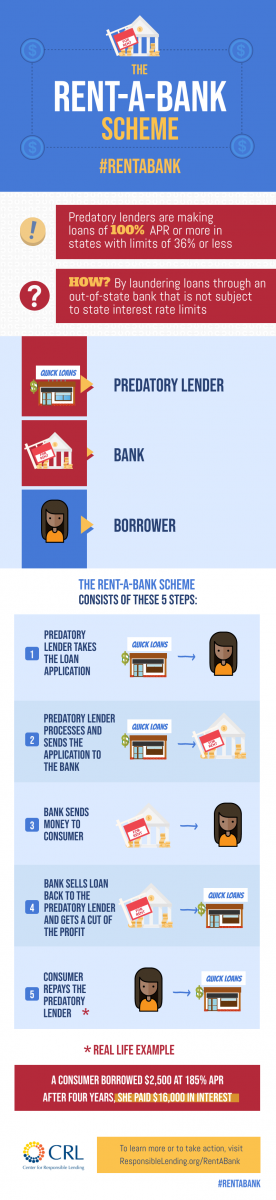

The Rent A Bank Scheme Center For Responsible Lending

Center For Responsible Lending Crlonline Twitter

Center For Responsible Lending Announces New Logo Center For Responsible Lending

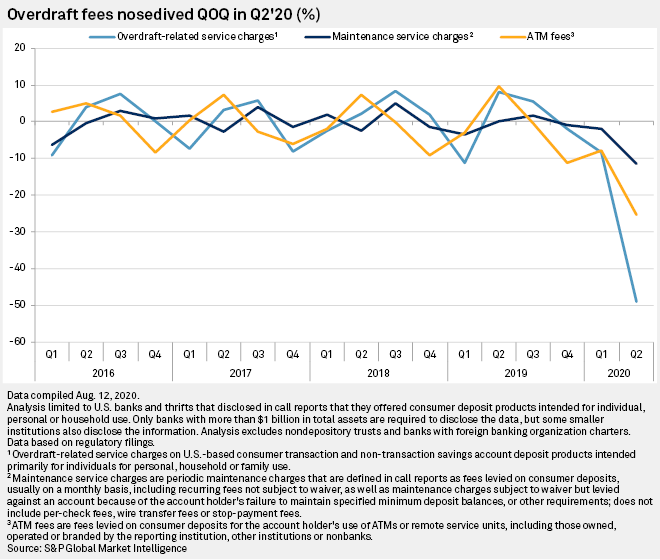

Overdraft Fees Plunge 49 Due To Covid 19 Shutdown S P Global Market Intelligence

Mike Calhoun On Twitter Capital One S Decision To Eliminate All Overdraft Fees Is A Groundbreaking Step Toward Financial Fairness Families Living Paycheck To Paycheck Who Bank With Capital One Will Sleep Easier Knowing They

Center For Responsible Lending գլխավոր էջ ֆեյսբուք

Overdraft U Student Bank Accounts Often Loaded With High

Abusive Overdraft Fees Drain Consumers Dry Center For Responsible Lending

Center For Responsible Lending Home Facebook